how does irs collect back taxes

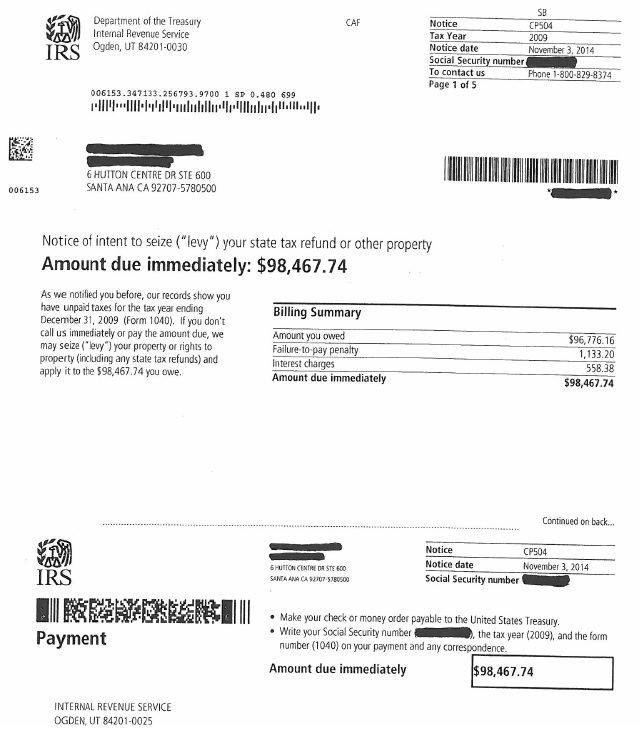

Filing a Notice of Federal Tax Lien Serving a Notice of Levy. Some of the actions the IRS may take to collect taxes include.

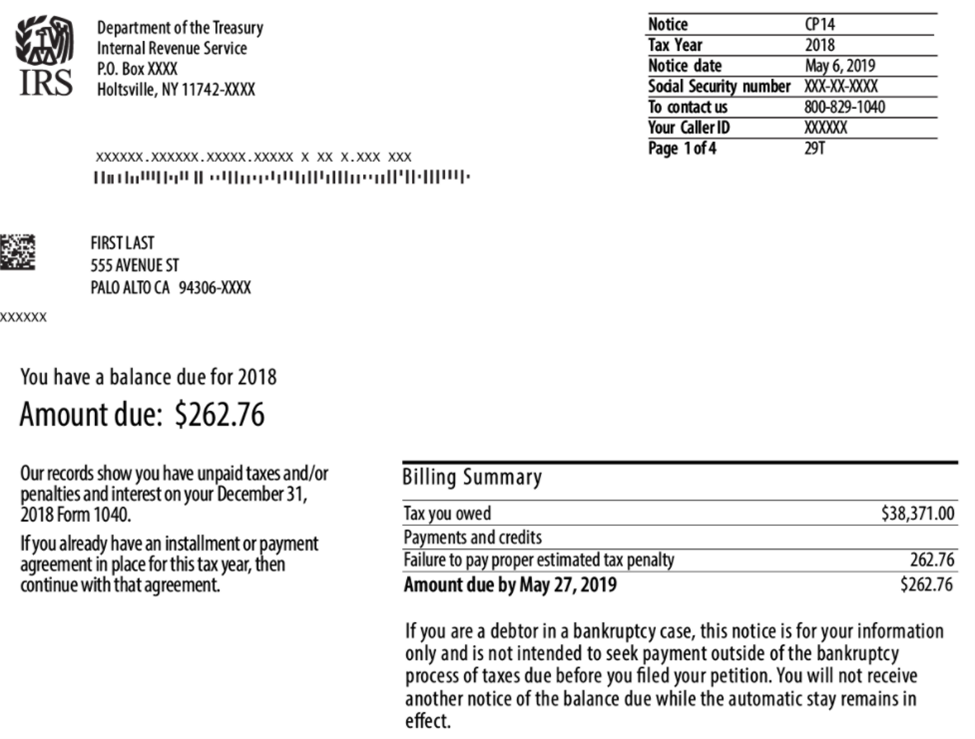

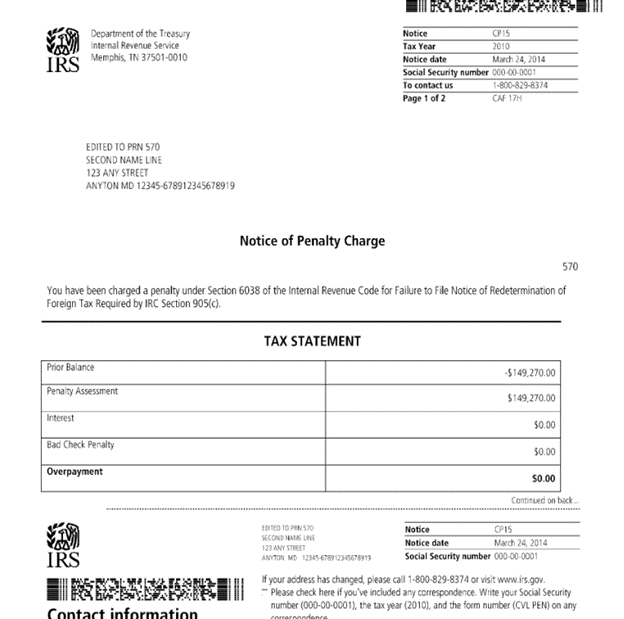

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

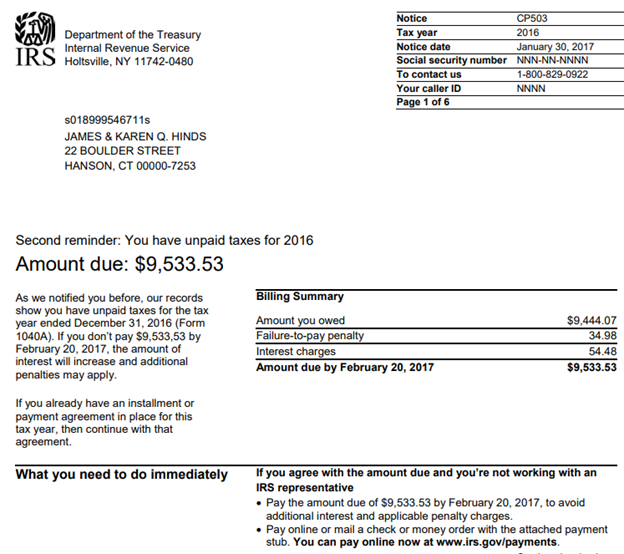

The IRS will first attempt to collect your back taxes by sending you balance due notices in the mail and giving you the chance to pay.

. How Long Does The IRS Have To Collect Back Taxes. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. This is known as the statute of.

This 10-year limit is known as the. The tax debts forgiveness date is called the Collection Statute Expiration Date CSED and it refers to the legal duration the IRS must obtain unpaid tax debts. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

The IRS doesnt pay out old refunds. Basically the case is either assigned to the IRS Automated Collections System or to a Revenue Officer. The Internal Revenue Code tax laws allows the IRS to collect on a delinquent debt for ten years from the date a return is due or the date it is actually filed whichever is later.

For most cases the. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. You can only claim refunds for returns filed within three years of the due date of the return.

How many years can the IRS collect back taxes. The best option is always to find ways to pay your taxes or discuss payment plans with the IRS. After this 10-year period or statute of limitations has.

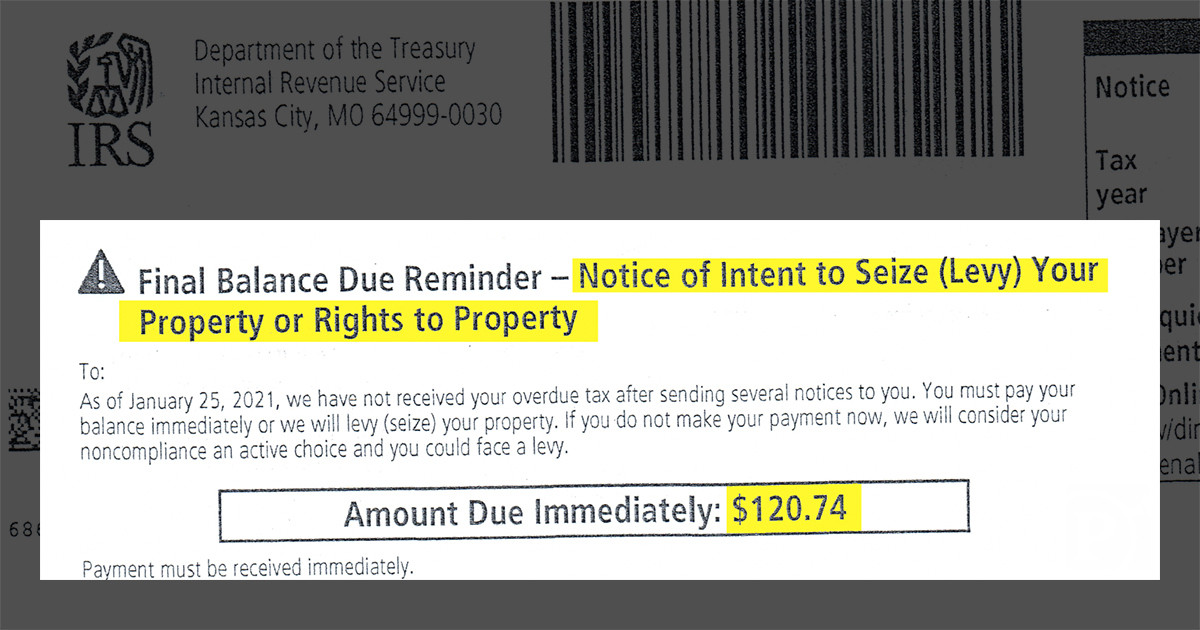

485 44 votes Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. They will begin to notify you about your debt and ask you to pay up. The levy process implies that the IRS can confiscate the property of a delinquent.

Filing a tax return billing and collection. How far back can the IRS collect unpaid taxes. After you file your tax return andor a final decision is made establishing.

How Does the IRS Collect Back Taxes. Here are the answers to this common question. In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions.

Everything before that is lost and you cannot. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. The IRS offers several options for taxpayers who cannot immediately pay unpaid taxes.

The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. A tax assessment determines how much you owe. The ideal tax relief option or IRS restart program that works for you depends on the amount of tax.

Your correct tax we. After this 10-year period or. Notice of levy is another standard IRS collections effort used to collect unpaid taxes.

Simply put the IRS only has ten years to collect back taxes before their legal right to do so is suspended. Serving a Notice of Levy. The IRS generally has 10 years from the date of assessment to collect on a balance due.

Offsetting a refund to which you are entitled. Publication 594 The IRS Collection Process. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

But before you get too excited its my moral obligation to tell you that its not as.

What To Do If You Owe The Irs Back Taxes H R Block

Irs Bank Levy You Have Options

Can Irs Collect After 10 Years 10 Year Statute Of Limitations Irs

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Column The Irs Hired Bill Collectors To Collect Back Taxes And Got Ripped Off Los Angeles Times

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Can The Irs Collect After 10 Years Fortress Tax Relief

Tax Debt Here S How To Handle Outstanding Federal Obligations

Irs Hardship Currently Non Collectable Alg

Virginia State Tax Resolution Options For Back Income Taxes

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How To Prevent And Remove Irs Tax Liens Bc Tax

Have You Received An Irs Tax Collection Notice

Filing Back Taxes What To Know Credit Karma Tax

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Why You Should Never Ignore An Irs Tax Bill Jackson Hewitt

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The